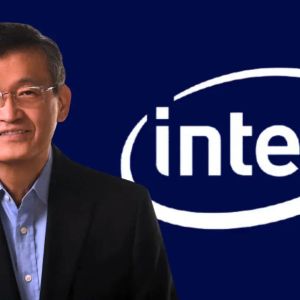

A government-backed rescue plan for Intel is being hashed out behind closed doors, with Donald Trump, Lip Bu Tan, and billions in federal oil driving the entire mess. The U.S. government, under Trump’s second term, is reportedly discussing taking an equity stake in Intel Corp to help fund the company’s delayed chip factory in Ohio, as reported by Bloomberg. The move, if finalized, would break from long-standing free-market policies and push America deeper into state-sponsored tech ownership, something previous presidents avoided. Intel’s stock surged 7.4% after the Bloomberg report hit, jumping 15% total since March, the same month Lip Bu Tan took over as CEO. Trump’s administration sees the potential investment as a way to shore up domestic chipmaking, which has been slipping under Intel’s watch. The deal is linked to the Chips Act, with funds originally meant as grants or loans now possibly being converted into actual equity. This would give the government a piece of the company at a time when Intel has been bleeding cash, laying off workers, and stalling its projects. Trump courts Lip Bu Tan after blasting Intel’s leadership Just days before the news broke, Trump called for Intel’s CEO to be removed. But after a private meeting, he reversed course. In a Truth Social post, Trump praised Lip’s background, calling it “an amazing story.” The change in tone came after the meeting, where Trump apparently saw value in Lip’s track record. That includes Lip’s twelve years running Cadence Design Systems, where he cashed out $575 million worth of shares and still holds another $500 million stake. Now at Intel, Lip’s leadership has already increased the value of his personal stake by more than $29 million, according to Bloomberg’s numbers. The deal being discussed could be the first time U.S. Chips Act funds are used to directly purchase ownership in a semiconductor company. Intel was already in line to receive $7.9 billion for commercial chipmaking and up to $3 billion more from the Pentagon for secure military-related manufacturing. On top of that, the company has access to $11 billion in federal loans. But that hasn’t stopped Intel from slashing spending or delaying production timelines. Despite all that cash, the Ohio plant is still behind. Bernstein analyst Stacy Rasgon, writing in a Friday note, said the firm isn’t sold on the hype. He told clients, “We’re still not hugely tempted to get involved.” Bernstein rates Intel at ‘market perform’ with a price target of $21, well below its latest close of $23.86. Rasgon said the current market reaction was mostly emotional: “The hope trade on Intel is probably back (for now) as investors wait to see if Trump can Make Intel Great Again.” Ohio becomes the key battlefield for tech and politics Intel’s Ohio project has taken on more than just manufacturing importance. Trump won the state three times, and Republicans flipped a Senate seat there in 2024. His vice president, JD Vance, used to serve as Ohio’s senator, and now former Democratic Senator Sherrod Brown is preparing to fight for his seat back in 2026. That makes Ohio a key political battlefield again, and dumping government money into a high-profile factory there could help Trump tighten his grip. The plan on the table could involve converting existing Chips Act grants into equity or pulling together a new mix of grants, loans, and other funding sources to purchase a stake. Everything is still being negotiated, and officials haven’t nailed down whether the funding will come from the original Intel package or somewhere else entirely. Earlier in the year, Trump’s advisors floated the idea of having Taiwan Semiconductor Manufacturing Company (TSMC) help run Intel’s factories. But TSMC CEO C.C. Wei shut that down, saying the company wasn’t interested in joint operations and would stay focused on its own plans. That left the Trump administration looking for another solution, one that now looks like the U.S. might just buy in. So far, the only ones truly winning from this are investors and Lip himself. Intel’s shares are rising based on hopes, not results. The actual factory’s still delayed, the company’s still struggling, and this deal, if it happens, just means Uncle Sam is throwing more oil into a fire that Intel started years ago. Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.